About Us

We provide our clients with truly independent and unbiased advice across a range of solutions where there is a Debt or Equity requirement.

Established in 1997, Maddox Capital has decades of experience and the ability to structure solutions to the most complex Debt or Equity requirements throughout the UK or Europe, utilizing our large network of investors and lending partners curated over decades.

OUR APPROACH

Maddox Capital creates

custom solutions for

its clients.

We help you secure the funding or equity you need for your projects, and we accomplish this in the most efficient, ethical, and practical manner possible.

We fully recognise the potential within a wide range of niche opportunities.

We respond quickly and strive for the best solutions for a clients’ funding needs.

We serve as the UK’s leading specialists in large debt structuring.

case studies

Ashford, Kent, SE England, £51m

Flexible Development Funding Facility to build out 130,000 sq ft high tech Distribution Centre for a global online retail client.

There was an initial equity release of £6m to develop the infrastructure surrounding the property and the client wanted a funding partner who would see the deal all the way through to conclusion, so the funding partner provided a further £45m development finance facility to develop out the project from start to finish.

Maddox Capital was able to provide the client with a full funding package that gave them the flexibility and security to undertake the complex planning application and technical processes required for a high tech property of that stature.

Contact Us

case studies

Kent, £57m

400-Unit Residential Development Site

Full development funding facility provided to UK National Housebuilder to build out 400 residential

units structured over 3 phases.

case studies

Enfield, London, £7.5m

2 Large Office Blocks

Refinanced into a short term facility to release cash to the property owner to pay an outstanding VAT liability and redeem an expired trade finance facility followed by a refinance onto a new long term corporate loan and more suitable trade finance facility.

case studies

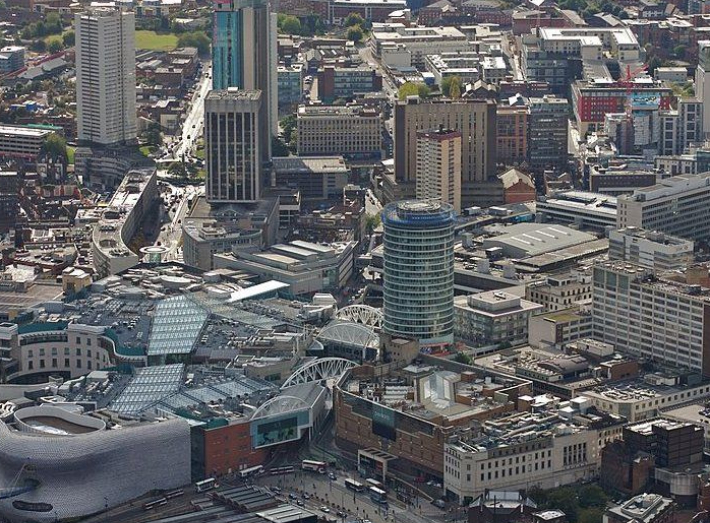

Central Birmingham, £10m

Land refinance of super high multi-use tower development. The client needed to extend banking facilities and refinance the existing land debt provider with new facility whilst planning amendments were processed.

Contact Us

case studies

Lower Holstein Germany, €22m

Refinance and equity release of mixed use investment portfolio with mainly residential units pending sale and retirement exit of principal partner.

Contact Us

case studies

Paris, France, €22m

Refinance of Luxury Estate owned in offshore vehicle by a Middle East client to fund new business venture in Middle East after obtaining a local banking license.

Contact Us

case studies

St John's Wood, North London £5m

Refinance bridging debt on multi unit residential complex for local developer onto cheaper long term finance.

Contact Us

case studies

Edinburgh, Scotland, £6m

Equity release on Development Land with Outline Planning Permission pending full planning permission and a development funding redemption.

Contact Us

case studies

Heathrow, London, £17.5m

Purchase funding for 200 unit development close to Heathrow Airport to cater for airport workers.

Contact Us